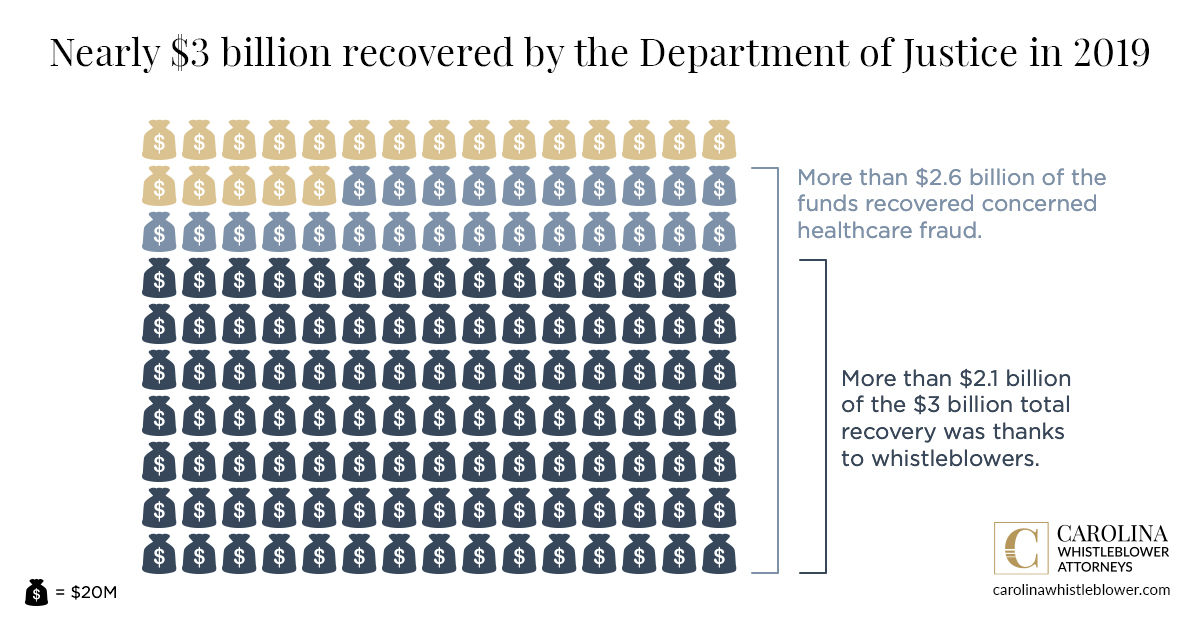

Whistleblowers helped the government detect fraud and recover more than $2.1 billion in qui tam claims in 2019. The Department of Justice recovered more than $3 billion overall, and more than $2.6 billion from fraud perpetrated by the healthcare industry. These figures show the value of courageous whistleblowers and skilled whistleblower attorneys who recover taxpayer funds from those who defraud the government – and through it, everyone who pays taxes.

- Nearly $3 billion recovered by Department of Justice in 2019

- More than $2.6 billion of the funds recovered concerned healthcare fraud

- More than $2.1 billion of the $3 billion total recovery was thanks to whistleblowers

Massive amounts recovered from healthcare fraud, qui tam relators recover rewards

In 2019, the government paid $265 million to whistleblowers who exposed fraud by filing suit under the False Claims Act. About 85% of False Claims Act recoveries came from healthcare fraud – $2.6 billion of more than $3 billion recovered. These healthcare-related funds arose from federal cases involving drug and medical device manufacturers, managed care providers, hospitals, pharmacies, hospice organizations, laboratories, and physicians. The DOJ also helped to recover hundreds of millions of dollars on behalf of state Medicaid programs.

Healthcare is an easy target for fraudsters, who often believe that they can simply charge the system for services they do not render, or for services far beyond those needed by patients in their care. Some individuals and companies “push the envelope” to maximize every cent they can milk from the healthcare system, and taxpayers end up footing the bill.

From bribing physicians to submitting false claims

In September, the California Bay Area’s largest home health care provider was charged with bribing physicians as part of a $115 million kickback scheme. Amity Home Health Care allegedly paid individuals in hospitals, skilled nursing facilities, and private facilities in the form of payroll, donations, reimbursements, and gifts.

The DOJ also charged a husband and wife for their six fraudulent home health agencies, three fraudulent therapy staffing companies, and two fraudulent pharmacies in Florida. The couple were sentenced to several years in jail for funding their lavish lifestyle. Through their false entities, the couple and co-conspirators submitted more than $38 million in false claims, of which $33 million went to Medicare.3

Fraud is still widespread – whistleblowers more important than ever

The Department of Justice (DOJ) reports that 2019 was the 10th consecutive year that its civil health care fraud settlements and judgments exceeded $2 billion. The $2.6 billion only includes federal cases, although the DOJ was instrumental in helping states recover from fraudulent claims to Medicaid programs, which are state run.

Since the False Claims Act was strengthened by Congress in 1986, the number of qui tam – that is, whistleblower – lawsuits filed has grown significantly. In 2019, there were 633 qui tam suits filed. That’s more than 12 new cases per week, on average. Since 1986, the False Claims Act whistleblower rewards are nearly $7.4 billion in total payouts.1 More than $5.6 billion of these payouts have come from exposing healthcare fraud.

7 types of healthcare fraud whistleblowers can expose

According to Fraud Magazine, here are seven types of healthcare fraud that whistleblowers may be able to spot.

- Kickbacks and bribery – Patients deserve to be referred based on merit, truth, and factual diagnosis. Paying for referrals is unfair and illegal, especially when the referrals are for treatments or services a patient doesn’t even need.

- Prescription fraud – With the price of prescription drugs, and the general lack of knowledge among patients, it’s easy for fraudsters to substitute cheap alternatives for prescribed medication. Prescriptions may also be written for unnecessary medications. Drugs might be stolen, and then false claims submitted showing they were prescribed. This is a particularly fertile ground for fraudulent activity.

- Overutilization – This happens when a healthcare provider orders as much as a patient’s insurance will cover or the patient can pay for it, even if the patient does not need.

- Incorrect diagnosis or procedures – This is a classic bait and switch scheme. A patient comes in with an issue, but the provider diagnoses the issue as far more serious than it really is in order to justify more numerous or expensive procedures that simply aren’t necessary. Basically, they’re padding their bill.

- Waiving deductibles or co-payments – This seems innocent at first. But the deductibles and co-payments serve a purpose other than cost offset. They ensure that a patient only seeks medical attention when they really need it. By waiving these costs (which they often make up with false claims), providers are encouraging patients to seek treatment for things that aren’t medically necessary, which raises premiums for everyone.

- Billing fraud – This comes in two versions. Billing for services that were never rendered is an old grift. A patient is prescribed three hours of treatment, and the provider bills for three hours while only providing one, for example. The other method is to bill for a non-covered treatment or service as though it were covered. Some treatments simply are not covered under insurance, but that won’t stop shady providers from providing those treatments and then coding them or billing them as something that will be covered. Perhaps the patient will pay for the service and so will the insurer – double profit. It can also simply be a way to appease patients who want a treatment that isn’t covered. It’s still fraud.

- Misrepresentation – This comes in three primary forms. The first is misrepresenting location, or where the treatment or service was rendered. Some types of services and treatments are only covered if they are rendered in a specific location, like a hospital or doctor’s office. If the patient isn’t in the office, the treatment isn’t covered. The second form of misrepresentation deals with the date of the service or treatment. If a provider treats a patient on two separate days rather than twice in the same day, the coverage payout could be higher. There are numerous other examples. The third misrepresentation is of who provided the service. Obviously, a physician rendering a service is more expensive than a nurse rendering the same service.

Bear in mind that for a qui tam claim to be filed, the suit must be brought on behalf of the government. Therefore, the healthcare fraud must arise from charges to Medicare, Medicaid, or TRICARE.

What to do if you’re aware of fraud Against Medicare, Medicaid, or TRICARE

It may seem isolating when you’re aware of fraud, and see it happening, but no one else seems to be doing anything about it. You may be afraid of losing your job if you speak up, or fearful of some other sort of retaliation. Don’t worry! Contact our experienced whistleblower attorneys discreetly and confidentially at 1-888-292-8852 for a free case evaluation. Qui tam lawsuits are filed under seal, and whistleblower identities are kept confidential. Don’t let fraud run rampant! Whistleblower awards can be up to 30% of the recovery, but the first to file is in the best position to receive a potential reward.

Similar Articles

Healthcare Fraud | March 07, 2024

Medicare Catheter Fraud Could Cost the Public $2 Billion

On January 9, 2024, The Washington Post and The New York Times reported on a...

Healthcare Fraud | March 16, 2023

What Is a Healthcare Kickback?

Each year, the Department of Justice’s False Claims Act recoveries are mostly from fraud in...

Healthcare Fraud | October 05, 2022

NC Healthcare Fraud Case Underscores Need for Whistleblowers

On June 23, 2022, the Department of Justice announced the indictment of a Charlotte-area physician...

Contact the Carolina

Whistleblower Attorneys

If you’re wondering if it’s a good idea to speak with a whistleblower lawyer about what you know, let us set the record straight.

- Corporate ethics hotlines can be risky and may lead to termination. If you’ve already done this, call us immediately.

- Your coworkers could be aware of the fraud – or complicit in it – and you should not talk to them about it.

- The first claim to be filed under the False Claims Act can proceed – if you’re not first, you’re at a serious disadvantage and may get nothing (another reason not to speak to your coworkers about it).

- A confidential discussion costs you a few minutes, but could save you time, stress, and money.

"*" indicates required fields